Will DeFi 2.0 meet the needs that users were looking for?

Will DeFi 2.0 meet the needs that users were looking for?

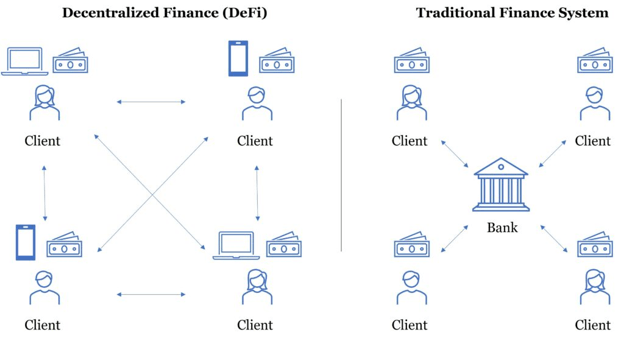

One of the most controversial topics in the blockchain environment is decentralized Finance, known as DeFi. It is essential that before talking about DeFi 2.0, to contextualize Decentralized Finance itself since this concept is necessary before tackling new topics.

Decentralized Finance 1.0 is a solution in blockchain technology that seeks to be an alternative to the traditional financial system. DeFi, short for Decentralized Finance, arises with the primary objective that the conventional financial central axes gain agility, transparency and decentralization. This new financial ecosystem is autonomous and automated since it works in conjunction with Smart Contracts.

Within this great idea, there are different services that support it. Over time, they have gained a lot of popularity, such as:

-Stablecoins

-Decentralized Exchanges (Dex),

-Loan platforms

-Prediction markets

-Derivatives

-Yield Farming, among others.

The Decentralized Exchanges (Dex) mentioned above are one of the most common and essential services in this financial ecosystem. These platforms allow the exchange of digital assets directly between investors in a decentralized way. However, liquidity is needed for these exchanges to be functional, which means that they require enough cryptocurrencies to operate and meet the users demand.

This liquidity comes from users who have deposited crypto in the Dex, these people receive rewards, called LP tokens (the benefit that the protocol gives you for providing liquidity). Thanks to smart contracts, every time a digital asset exchange is executed, there is a cost for the user and for the one who has deposited liquidity, there is a reward. Most of the time, the payment of the “reward” is given in the native currency, also called governance tokens (LP tokens).

But what is the problem?

The liquidity that these platforms have is LOANED by the depositors. These depositors are always looking for the platform that can provide the best rewards for them, which causes two main problems:

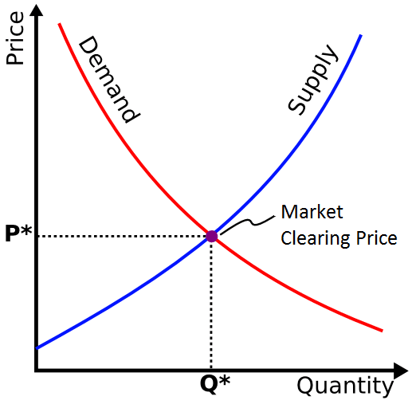

1. When the rewards are given in the protocol native currency, people sell this to ensure profit, which can cause it to fall in value , since there is more supply than demand for the cryptocurrency, causing the rewards in the protocol to decrease as well.

2. There are cases in which these exchanges do not have sufficient liquidity or due to the movement of whales (Depositors with a considerable amount of cryptocurrencies), are left without liquidity to provide an optimal service.

DeFi 2.0 was born to mitigate these problems

DeFi 2.0 seeks that the native currency does not lose its value as the traditional currency of the Dex on DeFi 1.0 and in this way, ensure that the capital does not escape towards the competition.

In summary: in DeFi 2.0, liquidity stops being borrowed, and the native token begins to be exchanged for a discount. A significant term is that of Protocol Own Liquidity (PVC), where instead of granting native tokens, they are sold to investors for liquidity at a discount.

These platforms have the native currency/tokens backed by the same capital that enters the Protocol. Now the owner of the liquidity is a Smart Contract and is responsible for supporting the currency. Through the liquidity that is blocked in this Protocol, a “Price floor” is created, thus achieving that the minimum price of the currency is maintained over time and that it also grows, since as there are new liquidity deposits in the Protocol, the currency raises its “Price floor”, which in a way limits its falling price, but NOT its ability to rise.

How do you gain profits on DeFi 2.0?

1. Buy the native currency of the Protocol on any decentralized exchange. Hold it until time passes.

2. Staking in the same protocols, they have excellent APY.

3. Acquiring bonds, so you can buy the native currency at a discount. (Exchange liquidity for discounts in native currencies)

4. Buying bonds and also staking the native currency

Example of a Protocol DeFi 2.0

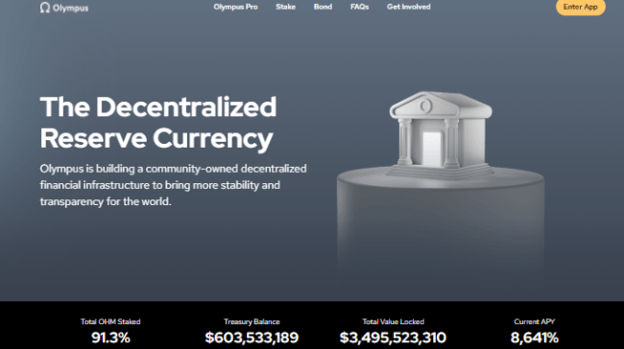

Olympus is building a community-owned decentralized financial infrastructure to bring more stability and transparency for the users. This protocol is based on the OHM token, which is backed by several assets in the Olympus treasury. The main idea of this project is to build a policy-controlled currency system, making sure that the behavior of the native token (OHM) is controlled by the OlympusDAO. It is important to mention that this protocol has been launched in May 2021 and since then it has been well received by crypto-users and has accumulated a large balance in its treasury as well as a considerable value blocked in its staking pool.

Last thoughts…

The DeFi industry continues to grow more and more. Although DeFi 2.0 appears with solutions to Defi 1.0, it does not mean that it will immediately remove all the projects and protocols that exist, but rather that it looks for a way to improve them. We consider it essential that users have a reasonable investigation of all projects that arise in this new environment to know if it is worth investing in. All of us as part of the crypto community contribute to the latent problems that interfere with its proper development and growth.